Sports Development Act 1997 Sports Equipment

Act 576 sport development act 1997 arrangement of sections p art i preliminary section 1.

Sports development act 1997 sports equipment. 2 this act shall come into force on such date or dates as the minister may by notification in the gazette appoint. Billiards and snooker 8. In order to achieve these objectives the act establishes inter alia the sports commissioner s office and the sports advisory panel. The sports development act was passed by parliament and gazetted on 25 september 1997.

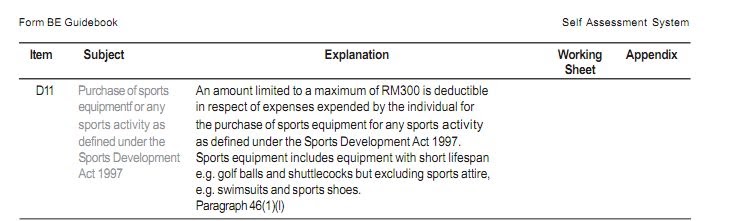

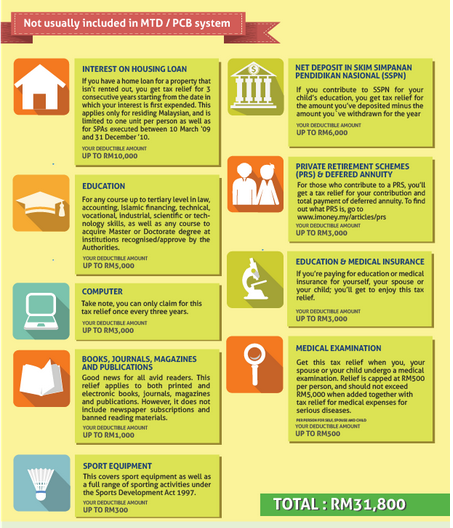

Short title application and commencement 2. Iii purchase of sports equipment for any sports activity as defined under the sports development act 1997 excluding motorised two wheel bicycles and gym memberships for self spouse or child. Associations etc to consult and coordinate with minister 5. Here is the list.

The following activities are regarded as sports for the purposes of this act. Interpretation p art ii sport development 3. 2 500 limited 9. Tax relief up to a maximum of rm 300 a year be given on purchase of sports equipment.

The sports equipment includes equipment with short lifespan such as golf balls and shuttlecocks but excluding sports attire e g. Purchase of breastfeeding equipment. Purchase of breastfeeding equipment. Guidelines in relation to sports development 4.

Defination of sports under sports development act 1997. And the minister may appoint different dates for the coming into force of different provisions of this act and for the application of this act to different parts of malaysia. 1 this act may be cited as the sports development act 1997 and shall apply throughout malaysia. Sports attire this part has been a point of confusion and contention when it comes to claiming tax relief for sports equipment.

Iii purchase of sports equipment for any sports activity as defined under the sports development act 1997 excluding motorized two wheel bicycles and gym memberships for self spouse or child. Swimsuits and sports shoes. Lhdn states in the income tax act that the tax relief for sports equipment is only eligible for those used in sporting activities defined in the sports development act 1997. And iv payment of monthly bill for internet subscription.

And iv payment of monthly bill for internet subscription. Purchase of sports equipment for any sports activity as defined under the sports development act 1997 not eligible for the purchase of sports clothing and shoes housing loan interest amount limited to a maximum of rmio ooo for each basis year for a period of 3 consecutive years conditions for eligibility. So what are the activities considered and defined as sports in the sports development act 1997. The term equipment is not defined and is thus open to discussion.